March 19, 2020

These are unprecedented times to be in business. As we face uncertain outcomes over the coming months it’s essential to make a plan to minimise the impact infection and isolation will have on your business.

If you don’t currently have a Business Continuity Plan – this is something we can help you with, we will be in touch again next week with some more information about how we can assist with this.

The government has also this week announced a business continuity package in response to Covid-19. The goal is to cushion the blow for businesses and workers and position for recovery. We encourage you to check out the details and see whether you could be eligible to receive this support.

The $12.1 billion package includes:

$5.1 billion in wage subsidies – available for businesses that have had a 30 percent decline in revenue due to Covid-19 (or forecasted decline) during the January to June months, compared to the same period last year. Eligible businesses will receive $585.50 per week for full-time staff, and $350 for part-time staff. (up to a total of $150,000 per business). Find out more about the wage subsidies and leave payments online here. As part of the process you will need to agree to a declaration that you intend to keep the individuals employed at a minimum of 80% of their usual pay and take active steps to mitigate the impact of COVID-19.

$126m in COVID-19 leave payment scheme and self-isolation support – eligible businesses will receive the same rates as the wage subsidy for those who are unable to work because they are in self-isolation, sick with COVID-19 or caring for dependents. The subsidy is not eligible for those who can work from home. Find out more about the wage subsidies and leave payments here.

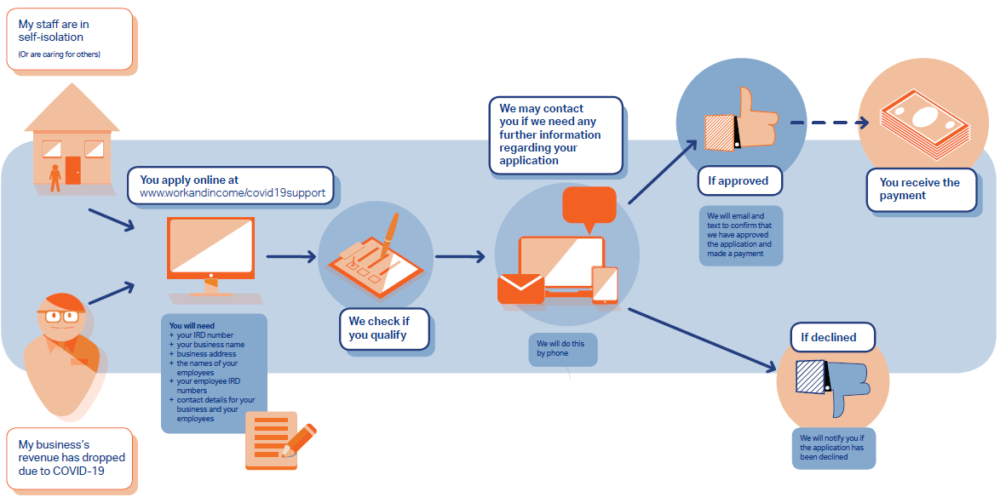

Self-employed and contractors may be eligible for the payments as well. Below is a visual outline of the application process and direct links to the application forms for both Employers and Self-Employed.

Payment Scheme and Wage Subsidy Application Process

$2.8 billion increase to income support – an extra $25 per week for all main benefits (approx 350,000 families) and the 2020 winter energy payment will be doubled, affecting approximately 850,000 recipients.

$2.8 billion in business tax changes to free up cashflow – including a provisional tax threshold lift from $2,500 to $5,000, the reinstatement of building depreciation and writing off interest on some late payment of tax. Read more about the tax initiatives here.

$100m for redeployment – supporting worker redeployment programmes.

$600m initial aviation support package – (Air NZ will be on top of this)

A $500 million boost for health – for health staff, virus testing, medicines and face masks, extra intensive care capacity and equipment at hospitals, as well as more money for GPs.

We will continue to pass along relevant information as it comes, with this in mind, we’d like to share with you an article from Vend that contains some helpful information for retailers navigating the challenges brought on by Covid-19. While it is aimed at the retail sector, it is worth a read and we think many of you will benefit from the information.

Please reach out if you have questions or need advice and support during this time. We can talk you through ways to moderate the stress on your business, help you develop a Business Continuity Plan and support you with information that you may need to supply as part of your subsidy application, such as cashflow forecasting for those anticipating a 30% drop in revenue over the coming months.